BAIC Money Thread. Investments ?

#31

Not as a whole, but I'm pretty sure I could argue they already failed individually at all these stores they had to shut down. There was no special reason beside loosing money and over saturation.

You could argue any remaining part of starbucks qualifies as not failing. But especially given the situation of someone who is going to open a store is our topic of discussion.................Yes all those stores failed, t

You could argue any remaining part of starbucks qualifies as not failing. But especially given the situation of someone who is going to open a store is our topic of discussion.................Yes all those stores failed, t

If you buy now and in 2-3 years the stock doubles, that would be an excellent investment, no? The only reason not buy is if you think it may go lower (and you wait to buy then) or if you think the company is doomed (I do not think its doomed).

#32

Then why did they open so many. The store were newer stores. The fact is it was a loss, I can go find the in depth article I guess to prove im not full of it.

Looking at it like they closed because they may have failed otherwise is a cop out.

Maybe if they never opened those stores they would have become the only coffee place ANYWHERE!

I just wanted to say starbucks is a pos company, i'm not saying they don't make any money......but terrible ethics..

SUBIEOCD- I think its really hard to tell whats doomed at this point. Besides everything.......seriously tho......I mean what if we can't afford the luxury of coffee in 2 years?? ..............i sure wouldn't bet all my money on it.

Also opening a starbucks seems like an idiotic idea.....i'd sure hope you could find something better.

Looking at it like they closed because they may have failed otherwise is a cop out.

Maybe if they never opened those stores they would have become the only coffee place ANYWHERE!

I just wanted to say starbucks is a pos company, i'm not saying they don't make any money......but terrible ethics..

SUBIEOCD- I think its really hard to tell whats doomed at this point. Besides everything.......seriously tho......I mean what if we can't afford the luxury of coffee in 2 years?? ..............i sure wouldn't bet all my money on it.

Also opening a starbucks seems like an idiotic idea.....i'd sure hope you could find something better.

#34

Then why did they open so many. The store were newer stores. The fact is it was a loss, I can go find the in depth article I guess to prove im not full of it.

Looking at it like they closed because they may have failed otherwise is a cop out.

Maybe if they never opened those stores they would have become the only coffee place ANYWHERE!

I just wanted to say starbucks is a pos company, i'm not saying they don't make any money......but terrible ethics..

SUBIEOCD- I think its really hard to tell whats doomed at this point. Besides everything.......seriously tho......I mean what if we can't afford the luxury of coffee in 2 years?? ..............i sure wouldn't bet all my money on it.

Also opening a starbucks seems like an idiotic idea.....i'd sure hope you could find something better.

Looking at it like they closed because they may have failed otherwise is a cop out.

Maybe if they never opened those stores they would have become the only coffee place ANYWHERE!

I just wanted to say starbucks is a pos company, i'm not saying they don't make any money......but terrible ethics..

SUBIEOCD- I think its really hard to tell whats doomed at this point. Besides everything.......seriously tho......I mean what if we can't afford the luxury of coffee in 2 years?? ..............i sure wouldn't bet all my money on it.

Also opening a starbucks seems like an idiotic idea.....i'd sure hope you could find something better.

As far as them being a POS company with bad ethics - what is your reasoning behind that?

I think you're misreading my posts. I'm not saying they should open more stores, what Im saying is - I think that the stock is undervalued and a good buy for a long term hold (thats what this thread is about). I dont know whats going to happen in 2 years either - thats why the market is so risky.

#35

Registered User

iTrader: (11)

Joined: Mar 2006

Posts: 1,075

From: San Francisco

Car Info: 05 WRB STi

Then why did they open so many. The store were newer stores. The fact is it was a loss, I can go find the in depth article I guess to prove im not full of it.

Looking at it like they closed because they may have failed otherwise is a cop out.

Maybe if they never opened those stores they would have become the only coffee place ANYWHERE!

I just wanted to say starbucks is a pos company, i'm not saying they don't make any money......but terrible ethics..

SUBIEOCD- I think its really hard to tell whats doomed at this point. Besides everything.......seriously tho......I mean what if we can't afford the luxury of coffee in 2 years?? ..............i sure wouldn't bet all my money on it.

Also opening a starbucks seems like an idiotic idea.....i'd sure hope you could find something better.

Looking at it like they closed because they may have failed otherwise is a cop out.

Maybe if they never opened those stores they would have become the only coffee place ANYWHERE!

I just wanted to say starbucks is a pos company, i'm not saying they don't make any money......but terrible ethics..

SUBIEOCD- I think its really hard to tell whats doomed at this point. Besides everything.......seriously tho......I mean what if we can't afford the luxury of coffee in 2 years?? ..............i sure wouldn't bet all my money on it.

Also opening a starbucks seems like an idiotic idea.....i'd sure hope you could find something better.

#36

Yes, opening so many stores was a bad idea in hindsight, they were losing money, the stores were underperfoming - thats why they closed them. Closing down the underperforming stores to concentrate on the existing stores and products was a good business decision.

As far as them being a POS company with bad ethics - what is your reasoning behind that?

I think you're misreading my posts. I'm not saying they should open more stores, what Im saying is - I think that the stock is undervalued and a good buy for a long term hold (thats what this thread is about). I dont know whats going to happen in 2 years either - thats why the market is so risky.

As far as them being a POS company with bad ethics - what is your reasoning behind that?

I think you're misreading my posts. I'm not saying they should open more stores, what Im saying is - I think that the stock is undervalued and a good buy for a long term hold (thats what this thread is about). I dont know whats going to happen in 2 years either - thats why the market is so risky.

I agree thats pretty cheap......the bad ethics thing is i've known a few people whom have work at different ones , plus we all know they got sued for taking tips from workers basically......

also just how they operate is pretty obvious.......I've been to towns rallying against "no starbucks"......but im pretty sure starbucks prevailed.

I dunno.......i'm not really disagreeing with your points tho......I think you may be right.

#37

Registered User

iTrader: (11)

Joined: Mar 2006

Posts: 1,075

From: San Francisco

Car Info: 05 WRB STi

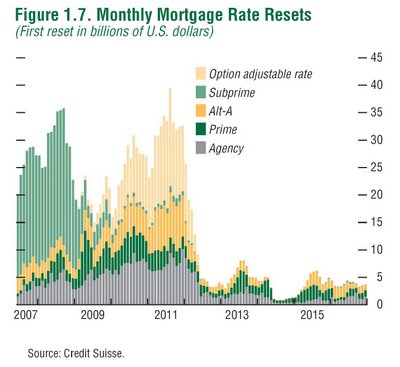

Alt-A, those resets are about to destroy the Bay Area. The subprime forclosures are just starting to hit the market. Its going to be another 4 years before everything is washed out.

Why buy now if you can get it cheaper later?

Why buy now if you can get it cheaper later?

#42

I have seen that graph before and I loosely understand that it represents when stability will return and such, but after looking at it for a bit - I have come to realise that I do not really get it 100%. Can someone explain it as well as the different loan types (eg: what is Alt-A)?

Thanks!

Thanks!

#43

I have seen that graph before and I loosely understand that it represents when stability will return and such, but after looking at it for a bit - I have come to realise that I do not really get it 100%. Can someone explain it as well as the different loan types (eg: what is Alt-A)?

Thanks!

Thanks!

In other cases, such as an option arm or pick a pay, borrowers can choose the monthly payment and in many cases they choose the minimum amount (which doesnt even cover the full interest!!). When the loan resets, the borrower owes MORE than the original loan (negative amoritization), the home has most likely lost value and the payments increase drastically.

So the graph is showing all the types of volitle mortgages and when they are resetting. Loan gurus feel free to correct me if I got something wrong.

#44

I'm no loan guru but here is the gist of it - A rate reset is when the teaser rate ends (usually 1% or 2%) and the loan resets to the new rate. The different types of loans (subprime, alt-a, options) have different teaser rates and terms. For example many subprime loans have teaser rates of 1-2 years, so the borrower pays the mortgage for a year, during that year thier home value sunk, then the mortgage resets and the borrowers loan rate increases. That leaves the borrower with a devalued home and a monthly payment of up to triple the original amount.

In other cases, such as an option arm or pick a pay, borrowers can choose the monthly payment and in many cases they choose the minimum amount (which doesnt even cover the full interest!!). When the loan resets, the borrower owes MORE than the original loan (negative amoritization), the home has most likely lost value and the payments increase drastically.

So the graph is showing all the types of volitle mortgages and when they are resetting. Loan gurus feel free to correct me if I got something wrong.

In other cases, such as an option arm or pick a pay, borrowers can choose the monthly payment and in many cases they choose the minimum amount (which doesnt even cover the full interest!!). When the loan resets, the borrower owes MORE than the original loan (negative amoritization), the home has most likely lost value and the payments increase drastically.

So the graph is showing all the types of volitle mortgages and when they are resetting. Loan gurus feel free to correct me if I got something wrong.

Thread

Thread Starter

Forum

Replies

Last Post

pleue

Bay Area

14

07-18-2010 08:39 PM

brucelee

Bay Area

18

12-04-2009 12:36 PM